is hoa tax deductible in california

Yes you can deduct your HOA fees from your taxes if you use your home as a rental property. In other words HOA fees are deductible as a rental expense.

Closing Costs That Are And Aren T Tax Deductible Lendingtree

The way to determine how much you can claim also.

. However if you use the home for some months and rent it the rest of the year you can claim a partial-year tax deduction on. Based on my research Ive found that the rules around HOA fees are the same in California as in other states. For example if you rent out the property six months of the year you can deduct six months worth of HOA fees on your tax return.

The IRS considers HOA fees as a rental expense which means you can write. Thus HOA donations are not tax-deductible. Additionally if you use the home as your primary.

The home must have been the principal place of residence of the owner on the. 60 Percent Test Sixty percent. So if your HOA dues are 4000 per year and you use 15 percent of your home as your permanent place of business you could deduct 15 percent of 4000 or 600.

The short answer is. You cannot deduct HOA fees unless you have a dedicated home office space if you live in the home. If you only rent out a portion of your.

There are many costs with homeownership that are tax-deductible such as your mortgage interest. For first-time homebuyers your HOA fees are almost never tax deductible. However since it is not subject to California corporation income tax it is also not taxable to the tax-exempt homeowners association.

Businesses that do not pay taxes in Colombia. Any HOA that has sizable. Homeowners donating to the HOA cannot deduct these on their tax returns.

Year-round residency in your property means HOA fees are not deductible. HOAs as Beneficiaries of Homeowners. If you qualify to deduct HOA fees you will need.

Deduct as a common business expense for your rental. HOA fees on personal residence - not deductible. HOA capital improvement assessments arent tax-deductible but theyre worth mentioning because the improvement could increase the cost basis of your home.

It is not tax-deductible if the home is your primary residence. You dont need to rent out your entire home for HOA fees to become deductible. Under section 528 HOAs are allowed to have non-exempt function income.

The California Constitution provides a 7000 reduction in the taxable value for a qualifying owner-occupied home. Say Thanks by clicking the thumb icon in a. It depends but usually no.

Is Hoa tax deductible in California. By Sophia Wayne Posted on March 12 2022. But the profit is taxed at the 30 rate as compared to the corporate tax that starts at 15.

A Homeowners Association HOA is a governing body that sets specific rules and guidelines that you agree to abide by when you purchase property in a condominium gated.

What Is An Hoa Tax Return What S The Process For Filing Hoam

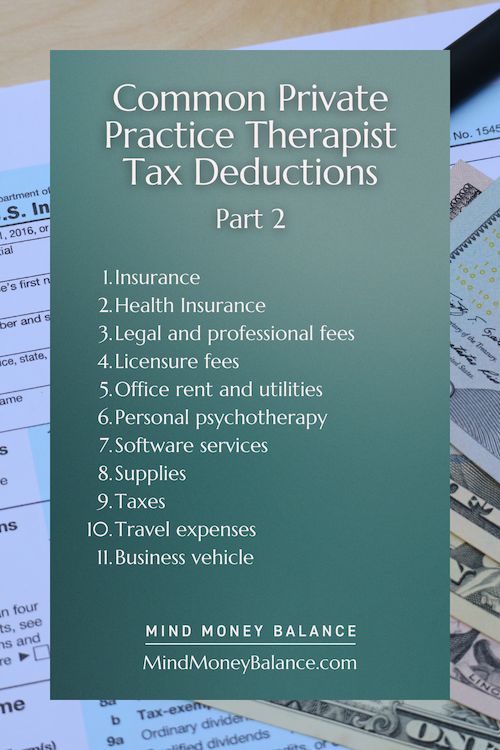

Tax Deductions For Therapists 15 Write Offs You Might Have Missed

Tax Deductions For Home Office A Guide For Small Businesses

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

Are Hoa Fees Tax Deductible Hoa Management Company Charlotte Nc

Rental Property Tax Deductions Property Tax Deduction

What Is Considered A Second Home For Tax Purposes Pacaso

Are Hoa Fees Tax Deductible Clark Simson Miller

Are Hoa Fees Tax Deductible Here S What You Need To Know

Tax Implications For Canadians Selling Us Property Real Estate Madan Ca

Estimated Tax Payments For Independent Contractors A Complete Guide

How Much Tax Do You Pay When You Sell Your House In California Property Escape

Can I Deduct Legal Fees On My Taxes Turbotax Tax Tips Videos

Are Hoa Fees Tax Deductible Clark Simson Miller

Are Landscaping Costs Tax Deductible

Can I Write Off Hoa Fees On My Taxes

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)